As the 2024-25 financial year draws to a close, it’s crucial for Australians to ensure their financial matters are in order. The end of the financial year (EOFY), falling on 30 June 2025, is a significant time for both individuals and businesses, requiring proactive preparation to meet tax obligations efficiently. Early planning can help avoid penalties and maximise financial benefits.

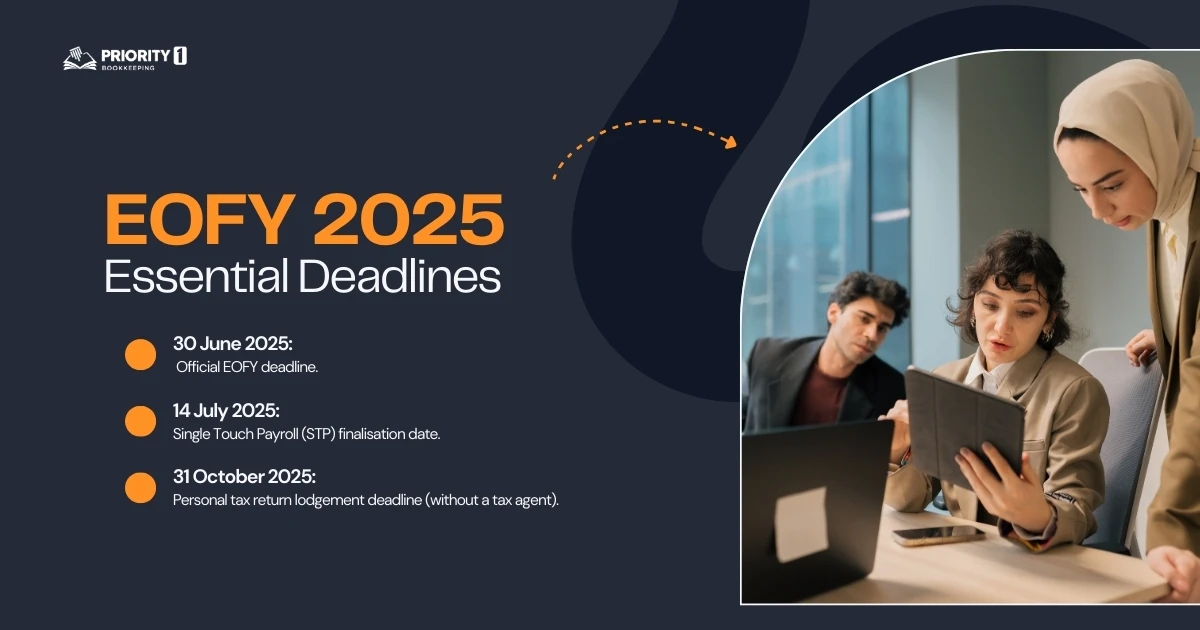

Being aware of key EOFY dates ensures smooth tax compliance:

Missing these deadlines can lead to penalties and fines, including late lodgement fees and interest charges on overdue amounts. In some cases, it could also trigger audits or increased scrutiny from the Australian Taxation Office (ATO). Delayed or incorrect compliance may result in additional administrative burdens, financial costs, and stress, reinforcing the importance of proactive planning and timely compliance.

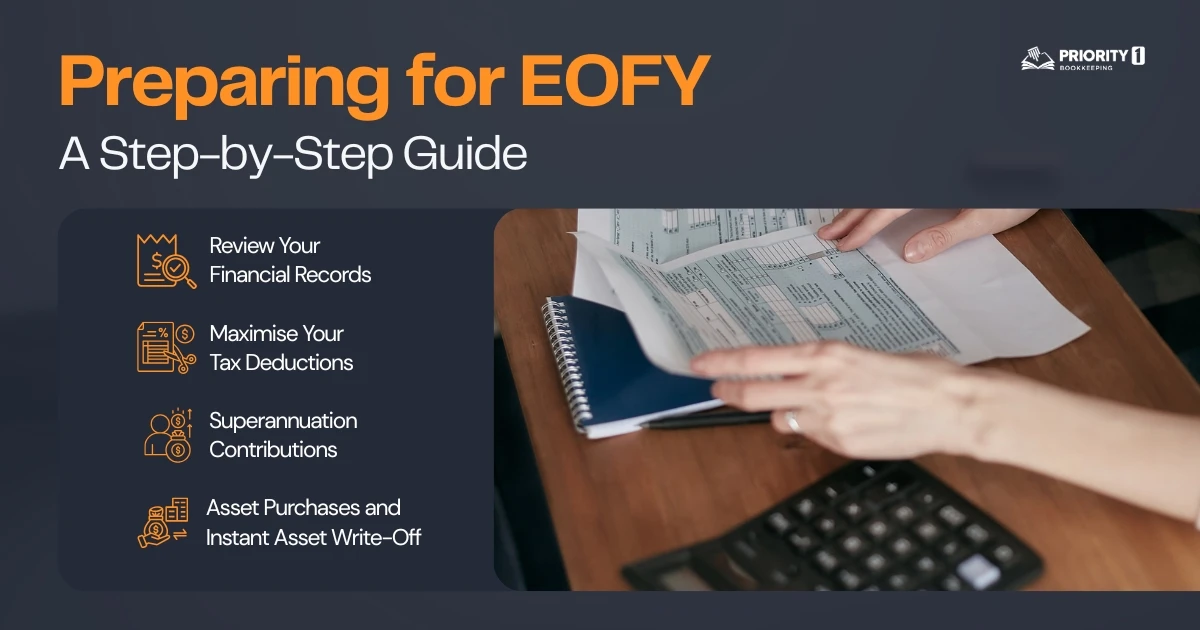

Accurate bookkeeping is fundamental at EOFY. Ensure all financial records are up-to-date and correctly recorded. Reconcile your bank accounts, verify statements, and address any discrepancies. Ensure invoices and debts are accurately tracked and managed.

Claiming eligible deductions effectively reduces taxable income. Common deductible expenses include:

Always keep clear documentation and receipts to substantiate your claims.

Superannuation is a tax-effective way to build retirement savings. Contributions must be within set limits to avoid extra taxes:

Consider additional super contributions before 30 June to optimise your tax outcome.

Eligible businesses can leverage the Instant Asset Write-Off scheme. If you need equipment or vehicles, purchasing these before EOFY could reduce your taxable income. Confirm eligibility criteria and thresholds to maximise this benefit.

Proactively managing your finances can yield considerable tax advantages:

Avoid common pitfalls to ensure a smooth EOFY:

Maintaining meticulous records and understanding tax deduction eligibility can prevent many common issues.

While some individuals and businesses manage EOFY tasks independently, professional guidance ensures accuracy and compliance. Qualified bookkeepers and accountants offer valuable insights and can:

Preparing for EOFY 2025 doesn’t need to be stressful. By understanding critical deadlines, maintaining accurate financial records, maximising deductions, and avoiding common mistakes, you can smoothly transition into the new financial year. For tailored advice and professional bookkeeping assistance, consider contacting Priority1 Bookkeeping to help streamline your EOFY preparations.

Missing the EOFY deadline can result in fines and penalties. Promptly lodge your tax return to mitigate potential issues.

Not all expenses are deductible. Expenses must directly relate to your income-earning activities and meet the ATO criteria.

Ensure your records are complete, reconciled with bank statements, and properly categorised, with documentation to support all transactions.

Yes, extra contributions can lower your taxable income and increase retirement savings but must stay within the contribution limits to avoid extra taxes.

You can lodge your return yourself; however, engaging a tax agent can simplify the process, improve accuracy, and often maximise potential deductions.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.