“Accounting is the language of business.”

Warren Buffett

Payroll is a critical function for every business, yet managing it can often become complex and time-consuming. Whether you are a small business owner in the NDIS sector or running a dental clinic, the payroll process demands precision. Missteps can lead to compliance issues, employee dissatisfaction, or even financial penalties. As businesses grow, the question of whether to manage payroll in-house or outsource it becomes a significant decision.

In this article, we will explore the pros and cons of both in-house and outsourced payroll accounting processes, helping you make an informed decision for your business.

Payroll accounting involves tracking, managing, and reporting all aspects of employee compensation, including wages, bonuses, deductions, and benefits. It ensures that payments are made accurately and on time, while also ensuring that taxes and other statutory obligations are met. Essentially, it’s a vital process for maintaining the financial health of your business and the happiness of your employees.

In Australia, businesses must comply with strict tax regulations, superannuation obligations, and reporting requirements. For sectors like NDIS, dental practices, tradies, and real estate, payroll services ensure that you meet your obligations without risking penalties. Whether you manage this process in-house or choose to outsource it, the accuracy of payroll accounting cannot be overstated.

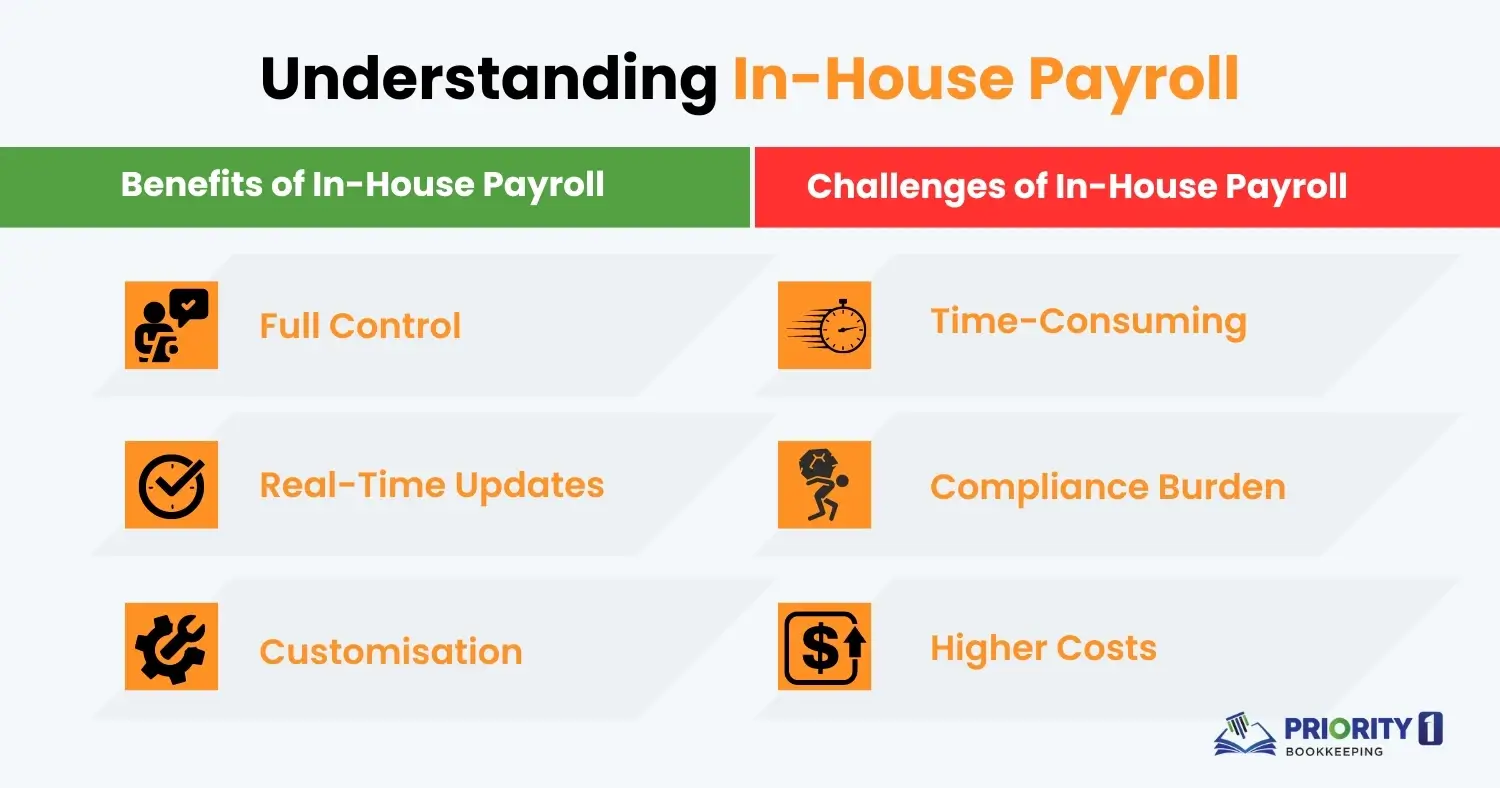

In-house payroll refers to the practice of managing all payroll-related activities within the company. This typically involves using payroll software or manually managing the process, handled by a company’s HR or accounting team.

Payroll outsourcing involves hiring a third-party provider to manage all aspects of payroll, from processing salaries to handling taxes and compliance reporting. Companies often opt to outsource payroll to reduce the burden on their internal teams.

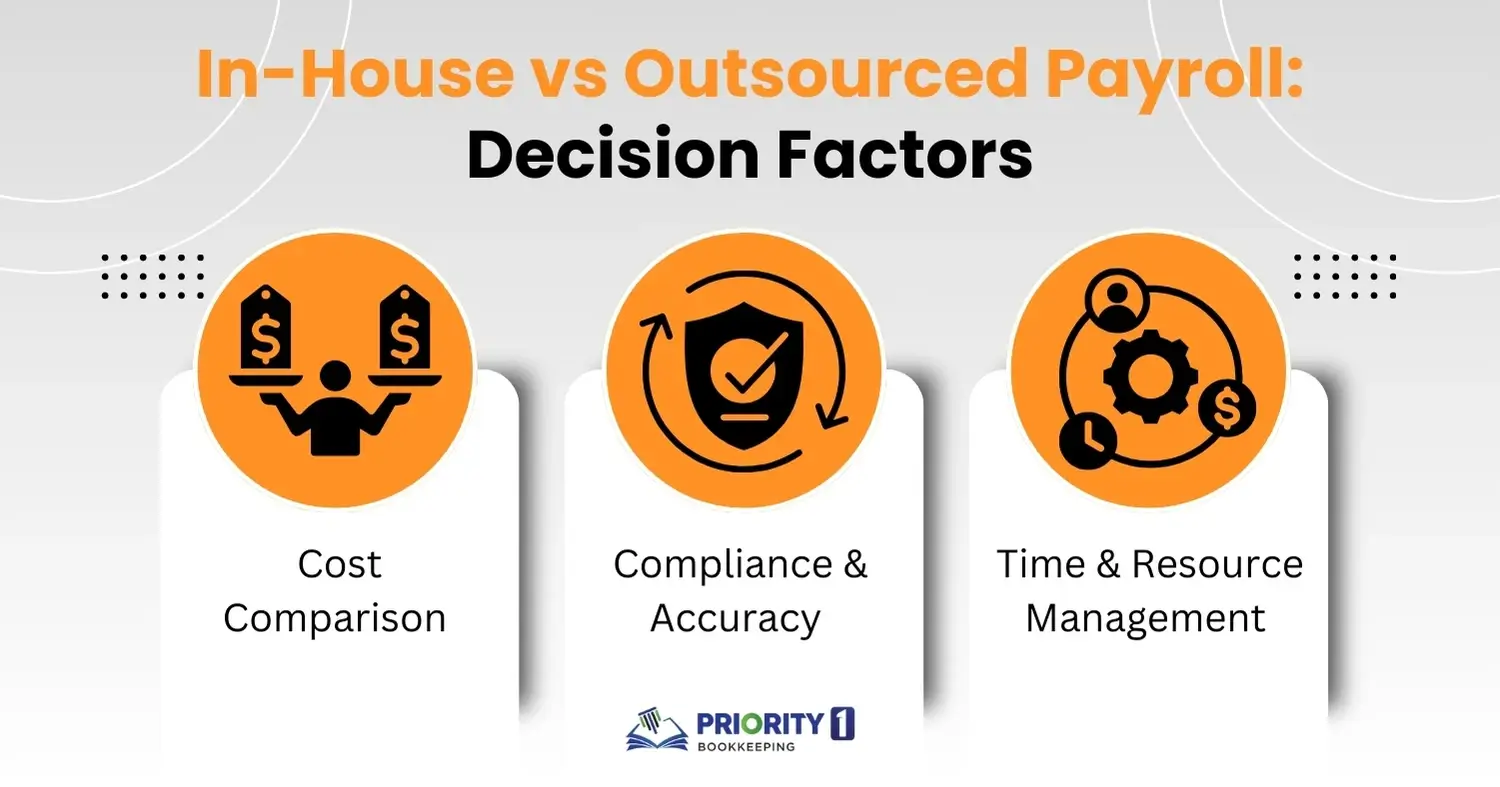

When it comes to cost, outsourcing is often the more budget-friendly option, especially for small businesses. You avoid the upfront costs of software and the ongoing cost of paying an in-house team. However, if your business is large enough, in-house payroll can offer long-term cost savings by eliminating outsourcing fees.

Outsourcing payroll ensures you stay compliant with tax laws and employee regulations, as providers typically specialise in payroll management and keep up with legislation. In-house payroll, on the other hand, requires constant vigilance to remain up-to-date with regulatory changes. In the 2024 Australian Payroll Association survey, 74% of businesses cited compliance as the top reason for outsourcing payroll.

For small businesses, time is a precious commodity. In-house payroll can consume a significant amount of time, especially when handling errors or late payments. Outsourcing allows you to redirect that time into growing your business and servicing your customers, whether you are in the healthcare or real estate industry.

Your decision to manage payroll in-house or outsource it depends on your business needs. If you have a small, dedicated accounting team and value control, in-house payroll might work for you. However, if compliance, cost savings, and time efficiency are priorities, outsourcing payroll could be the smarter choice.

Deciding whether to manage payroll in-house or outsource it to a professional service is a critical decision for any business. Here are some key factors to help guide your choice:

Criteria | In-House Payroll | Outsourced Payroll |

Cost | Higher upfront costs (software, staffing, training). Lower ongoing costs if managed efficiently. | Ongoing service fees but may save on indirect costs like compliance penalties or errors. |

Control | Full control over payroll processes and sensitive data. Customisable to specific needs. | Less control over day-to-day operations but can delegate time-consuming tasks. |

Compliance | Requires constant updates on changing tax laws and regulations. High risk of errors if not managed properly. | Managed by payroll experts who stay updated on industry laws and regulations. Minimises compliance risks. |

Scalability | Limited scalability. As your business grows, you’ll need more resources to manage payroll. | Highly scalable. Can easily adapt to changes in employee numbers or business expansion. |

Technology | Requires investment in payroll software and maintenance. Integration with existing systems can be customised. | Payroll service providers often use advanced technology. Integration may vary depending on the provider. |

Security | Full responsibility for securing sensitive payroll data (requires robust internal security measures). | Typically offers advanced security protocols, such as encryption and regular security audits. |

Time and Resources | Time-consuming, especially for businesses with a large workforce. Requires dedicated staff to manage. | Saves time by delegating payroll processing, allowing businesses to focus on core functions. |

Accuracy | Prone to errors if staff are inexperienced or overwhelmed. Mistakes may lead to costly penalties. | Higher accuracy due to expertise and automation in payroll processing. Reduced likelihood of errors. |

Customisation | Easily customisable to specific payroll needs (e.g., industry-specific requirements, custom reports). | Some level of customisation but may be limited based on the provider’s services. |

Employee Access | May require additional resources to set up employee self-service portals for paystubs or tax info. | Most providers offer employee self-service portals for easy access to payroll information. |

Support and Troubleshooting | Internal staff may face challenges resolving issues without external expertise. | Dedicated support teams provide faster troubleshooting and solutions for payroll issues. |

Implementation Time | Takes time to set up systems, train staff, and ensure accuracy. | Quick and easy to implement with minimal effort from the business side. |

The 2024 Australian Payroll Association Survey highlighted significant trends in payroll management across Australian businesses:

These trends emphasise that businesses in Australia are increasingly turning to outsourcing and automation to handle their payroll more effectively, especially in sectors like healthcare, real estate, and tradies.

Outsourcing payroll accounting can streamline your business operations and reduce stress. Here’s a step-by-step guide to ensure a smooth transition:

Before reaching out to payroll providers, assess your current payroll process. Identify areas where you’re struggling or where you see inefficiencies. Determine what services you need: payroll processing, tax filing, employee benefits administration, or compliance management.

Start researching payroll providers that cater to your specific industry. For businesses like NDIS service providers, tradies, healthcare, or real estate, it’s essential to choose a service with expertise in industry-specific regulations. Create a shortlist of potential providers, checking their reviews, pricing, and services offered.

Reach out to your shortlisted providers and request proposals. Many payroll companies, including Priority1 Bookkeeping, offer demos or consultations to show how their services work. Use this opportunity to ask about customisation, integration with your existing systems, and security protocols.

Once you have proposals, compare both the costs and the services offered. Some providers offer basic payroll services, while others include tax filing, compliance, benefits management, and employee self-service portals. Make sure to choose a service that aligns with your business’s long-term needs.

Payroll data is highly sensitive, so make sure the provider uses advanced security measures, including encryption, regular audits, and compliance with privacy laws. Verify that the provider is compliant with Australian payroll regulations to ensure your business doesn’t risk penalties.

Establish clear communication with your chosen provider. Discuss the terms of service, frequency of reporting, and turnaround times for payroll processing. Service Level Agreements (SLAs) should outline how quickly payroll issues will be resolved and what level of support you can expect.

Once you’ve chosen a provider, the next step is to transfer your payroll data securely. This can include employee details, tax information, pay structures, and historical payroll records. The provider will typically assist with the migration process to ensure a seamless transition.

Inform your employees about the transition to outsourced payroll. Provide them with any new login credentials or access information for employee self-service portals. Make sure they understand any changes in how they’ll receive pay stubs or tax information.

Before fully transitioning, it’s a good idea to run a test payroll cycle to ensure everything runs smoothly. Double-check calculations, deductions, and tax filings to ensure accuracy. Address any discrepancies with your provider before going live.

Once your payroll outsourcing is in full swing, regularly monitor its performance. Schedule check-ins with your provider to review SLAs and address any concerns. Make adjustments to your service agreement as your business evolves or your payroll needs change.

Both in-house and outsourced payroll have their own sets of advantages and challenges. In-house payroll offers control and customisation, but requires a time investment and can pose compliance risks. Outsourcing, on the other hand, offers cost savings, expert knowledge, and efficiency, but with less control. Ultimately, the right choice will depend on the size of your business, the complexity of your payroll, and the resources you have at hand.

The primary advantage is time and cost efficiency, along with ensuring compliance with complex regulations.

Costs vary depending on the provider and the size of the business, but generally, businesses save 20-25% compared to in-house payroll, according to the 2024 Australian Payroll Association survey.

In-house payroll can offer better control over sensitive data, but many outsourced providers also offer high-level security measures.

Yes, many payroll outsourcing companies offer customisable services to fit your business needs.

Small businesses in sectors like NDIS, dental, tradies, and healthcare often benefit the most from outsourcing payroll due to cost savings and compliance needs.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.