Managing finances is one of the most vital responsibilities for any business, yet it can also be one of the most time-consuming and complex. Many business owners, especially those in small and medium-sized enterprises (SMEs), struggle to keep their financial records organised while juggling numerous other tasks. This is where outsourced bookkeeping comes into play. With expert services like Priority1 Bookkeeping, businesses can offload this crucial responsibility, allowing them to focus on growth and other key areas. In this article, we’ll explore the many facets of outsourced bookkeeping and how it can revolutionise your business’s financial management.

Outsourced bookkeeping is the process of hiring an external service provider to handle your financial records instead of managing them in-house. The outsourced team becomes responsible for key tasks like recording daily transactions, managing payroll, preparing tax filings, and generating financial reports. This allows businesses to access professional financial management without the overhead costs associated with hiring full-time staff.

At its core, outsourced bookkeeping is a partnership. A firm like Priority1 Bookkeeping works closely with you to understand your specific needs and customises their services accordingly. Whether you’re a start-up just beginning to generate revenue or a more established company with complex financial needs, outsourced bookkeeping can be adapted to fit your situation.

Accurate bookkeeping is foundational to the success of any business. It ensures that every financial transaction is recorded correctly, allowing business owners to maintain a clear picture of their company’s financial health. Inaccurate or delayed bookkeeping can lead to a range of issues, from cash flow shortages to compliance risks.

Without proper bookkeeping, businesses may miss important financial deadlines, such as tax filings, which can result in penalties. Furthermore, poor bookkeeping may prevent you from identifying financial trends, making it difficult to make strategic decisions. Outsourcing your bookkeeping to experts like Priority1 Bookkeeping ensures that your financial records are always accurate and up to date.

Outsourced bookkeeping offers a variety of benefits that can have a significant impact on your business. Here are some key advantages:

Time-saving: Managing your finances, from tracking expenses to reconciling accounts, can be incredibly time-consuming. By outsourcing these tasks, you free up valuable time that you can devote to other aspects of your business, such as customer service, product development, or marketing.

Cost-effective: Hiring a full-time, in-house bookkeeper for small business can be expensive. Outsourcing allows you to pay only for the services you need, without the additional costs associated with salaries, benefits, or office space.

Expertise: With an outsourced service, you gain access to experienced professionals who specialise in financial management. These experts are up to date with the latest regulations, tax codes, and accounting practices, ensuring that your business remains compliant and that your finances are managed optimally.

Scalability: As your business grows, your financial management needs will evolve. Outsourced bookkeeping offers the flexibility to scale up (or down) the level of service you require. This means you can adjust your bookkeeping services as your business expands, without the need to hire additional in-house staff.

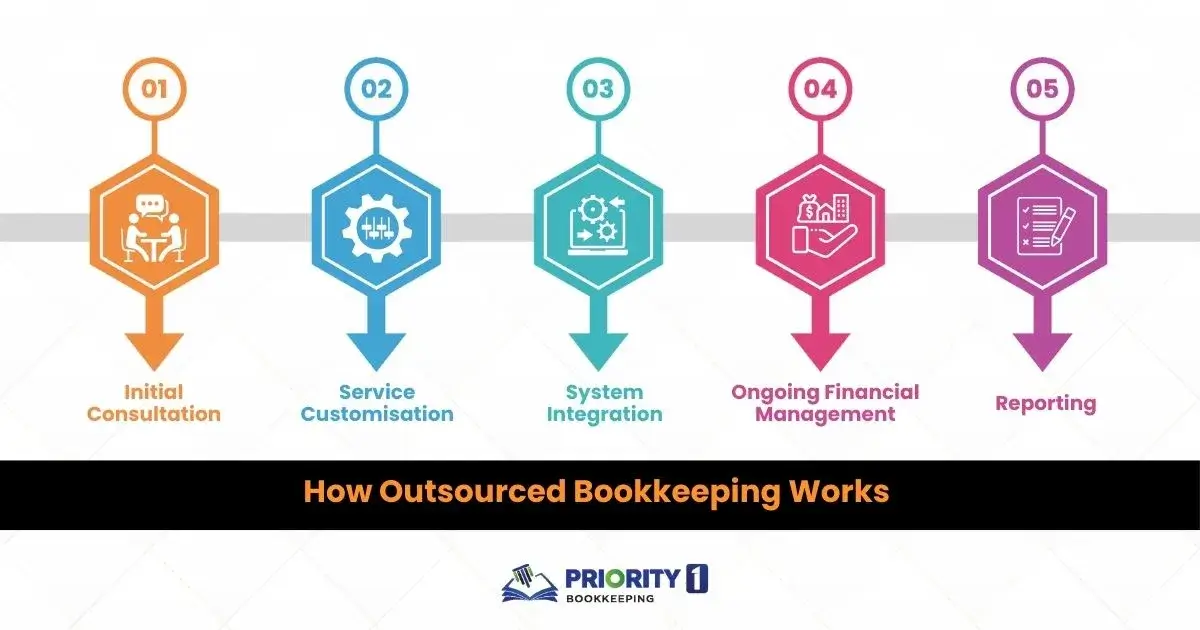

The process of outsourcing bookkeeping is straightforward, and it can be tailored to suit businesses of all sizes. Here’s a general overview of how it works:

Initial Consultation: The process begins with a consultation where you and the bookkeeping provider assess your business’s needs. This may include identifying areas such as payroll management, tax preparation, and financial reporting.

Service Customisation: Based on your needs, the outsourced firm will customise its services to fit your business. This could mean handling your entire bookkeeping function or supporting specific tasks such as monthly reconciliations.

System Integration: Most modern bookkeeping services, like Priority1 Bookkeeping, integrate with your existing financial systems using cloud-based software. This ensures seamless tracking of all transactions in real-time and allows for instant access to financial data from anywhere.

Ongoing Financial Management: Once set up, the outsourced team handles the day-to-day financial tasks, including recording transactions, managing accounts payable and receivable, reconciling bank statements, and preparing financial reports.

Reporting: Throughout the process, you’ll receive regular updates and financial reports, which can help you make informed business decisions. This ongoing reporting allows you to monitor the financial health of your business without needing to dive into the details yourself.

Bookkeeping is a broad field, encompassing various tasks that help keep your financial records organised and accurate. Here are some of the core services offered by outsourced bookkeeping providers like Priority1 Bookkeeping:

General Ledger Management: Maintaining a record of every transaction, from sales to expenses. This is the foundation of all financial reporting and analysis.

Payroll Processing: Ensuring employees are paid accurately and on time, while also managing payroll taxes and other deductions.

Financial Reporting and Analysis: Generating detailed reports that give insights into your business’s financial health. This includes profit and loss statements, balance sheets, and cash flow statements.

Tax Preparation and Compliance: Preparing and filing business taxes, ensuring you stay compliant with tax laws, and minimising your tax liability.

Accounts Receivable and Payable Management: Tracking incoming payments from customers and outgoing payments to vendors, ensuring smooth cash flow management.

Small businesses, in particular, stand to benefit greatly from outsourcing their bookkeeping. Here’s why:

Limited In-House Resources: Most small businesses lack the budget to hire full-time financial staff. Outsourcing allows them to access professional bookkeeping services without the high costs of employing in-house personnel.

Scalability and Flexibility: Small businesses often face fluctuating financial demands. Outsourced bookkeeping allows for flexible solutions that can be scaled to meet the business’s changing needs.

Customised Solutions: Outsourced bookkeeping can be tailored to your business’s unique financial requirements. Whether you need help with taxes, payroll, or financial reporting, services can be customised to fit your needs and budget.

Cash flow management is critical to the survival and growth of any business. Outsourced bookkeeping helps improve cash flow in several ways:

Timely Invoicing: A dedicated bookkeeper ensures that your invoices are sent out on time, reducing the likelihood of late payments.

Expense Tracking: By carefully monitoring expenses, an outsourced service can identify areas where you might be overspending or where costs can be reduced.

Real-time Financial Tracking: With modern, cloud-based bookkeeping systems, you can track your business’s financial performance in real time, allowing for quicker decisions about managing cash flow.

Today’s bookkeeping is more efficient and accurate than ever, thanks to advancements in cloud-based technology. Tools like QuickBooks, Xero, and FreshBooks enable both businesses and their outsourced bookkeepers to collaborate in real-time. These platforms allow you to access up-to-date financial data, generate instant reports, and even automate certain tasks like invoicing and bank reconciliations.

At Priority1 Bookkeeping, we leverage cutting-edge software to ensure seamless integration with your business systems, providing accurate financial data at the click of a button.

Not all outsourced bookkeeping providers are created equal. When choosing a provider, consider the following factors:

Experience and Expertise: Look for a provider with a proven track record in your industry. Priority1 Bookkeeping, for example, has years of experience working with businesses in various sectors, offering tailored solutions to meet specific needs.

Services Offered: Make sure the provider offers the specific services you require, whether it’s tax preparation, payroll management, or financial reporting.

Communication: Choose a provider that offers clear and open communication. You want to work with a team that will keep you informed and provide regular updates on your financial situation.

Security: Given the sensitive nature of financial data, it’s crucial to choose a provider that prioritises security. Priority1 Bookkeeping employs strict data protection protocols to safeguard your information.

Financial data is among the most sensitive information a business can handle, and outsourcing this responsibility requires trust. At Priority1 Bookkeeping, we understand the importance of protecting your financial information. Our firm uses top-tier encryption and secure cloud storage solutions to ensure that your data is always protected from unauthorised access or breaches. We adhere to strict confidentiality agreements, so you can trust that your business’s financial details remain private.

Many business owners hesitate to outsource their bookkeeping due to common misconceptions. Let’s address a few of these myths:

Myth: Outsourcing is only for large companies

Outsourced bookkeeping is not exclusive to big corporations. In fact, it’s especially beneficial for small businesses, providing access to professional services without the overhead costs.

Myth: You’ll lose control of your finances

Contrary to this belief, outsourcing often gives business owners more control and visibility into their finances. Regular updates and detailed financial reports keep you informed and empowered to make better business decisions.

Myth: It’s too expensive

While outsourcing involves a cost, it’s typically far more affordable than hiring full-time staff. You only pay for the services you need, which makes it a cost-effective solution for most businesses.

Still not sure if it’s time to outsource? Here are a few signs that your business might benefit from outsourced bookkeeping:

Overwhelming Financial Paperwork: If you’re drowning in receipts, invoices, and other financial documents, it’s time to bring in help.

Inaccurate or Outdated Records: Keeping your financial records accurate and current is critical for compliance and decision-making. If your books are behind or filled with errors, outsourcing could save you from major headaches down the line.

Lack of Time for Core Business Activities: If managing your finances is taking time away from growing your business or serving your customers, outsourcing can free up your schedule.

Outsourcing bookkeeping can have a profound impact on the long-term success of your business. Accurate financial data allows for better decision-making, helping you identify profitable areas to invest in and areas where costs can be cut. Additionally, by relieving the burden of financial management, you’ll have more time to focus on strategic business initiatives and growth opportunities.

For example, if you’re looking to expand your business, accurate bookkeeping can help you secure funding from investors or lenders by providing a clear picture of your financial health.

Outsourced bookkeeping offers a practical, cost-effective solution for businesses looking to simplify their financial management. By partnering with a professional service like Priority1 Bookkeeping, you can save time, reduce costs, and gain access to expert financial advice, all while ensuring your business’s financial records are accurate and up to date. Whether you’re a small start-up or an established business, outsourcing your bookkeeping can be a game-changer, freeing you to focus on what truly matters—growing your business.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.