An effective billing and collections process for healthcare providers will be instrumental in helping them achieve their financial health. Billing and collections form some of the most essential processes in the care of patients, which no healthcare practice can afford to overlook with regard to its financial health. As already mentioned, the intricacies involved in the Medicare system, private health insurance, and specific regulations that govern health billing make financial management such a complex task. In fact, studies conducted by the RACGP revealed that a revenue loss between 15-20% in some practices were resulted from unbalanced and inefficient billing and collection processes. Improved medical bookkeeping processes together with medical accounting and proper collection strategies can ensure smooth cash flow and make things easier for healthcare practitioners to do their quality work.

Medical billing in Australia refers to the process of charging patients or insurers for the healthcare services provided. This can involve bulk billing to Medicare or private billing where patients pay and are later reimbursed by their private health insurance. Effective billing processes ensure that healthcare providers get paid correctly and on time for the services they deliver.

Most significantly, proper billing and collections ensure the financial viability of healthcare providers. A non-streamlined process can lead to delayed payments, disallowed claims, and undeclared balances that, negatively, affect cash flow. These losses become huge over time and squeeze the practice financially.

While billing and collections may be stereotypical administrative functions, they can provide a solid foundation for keeping the business afloat for healthcare providers. When well managed, an efficient system allows providers to do what they do best: provide care for patients with a healthy financial bottom line. An efficient billing process would also prevent non-compliance, something that the ever-growing complexity of Medicare and private insurance regulations will not help avoid, resulting in costly penalties or audits.

A good system in any medical bookkeeping and medical accounting will benefit in maintaining a track of payments and outstanding claims, accurately keeping financial records—all of which are elements for long-term sustainability.

Health care billing is a mix of Medicare, private health insurance, and out-of-pocket payments. However, in the case of running a general practice or a specialist clinic, management complexity becomes all the more important for maintaining the financial health of your practice. What’s more, it is also necessary for the smooth operation of claim management under Medicare and private insurance regulations.

Without proper billing, payments get delayed, and claims go unpaid. On the flip side, when you streamline your billing process, claims get processed faster, patients know what they owe, and your cash flow stays strong. It’s not just about keeping the books in order—it’s about enhancing patient satisfaction, staying compliant, and ensuring you get paid on time.

With medical billing and collections being as complex a task as it already is for healthcare practices –Illegal balance billings only complicates matters.

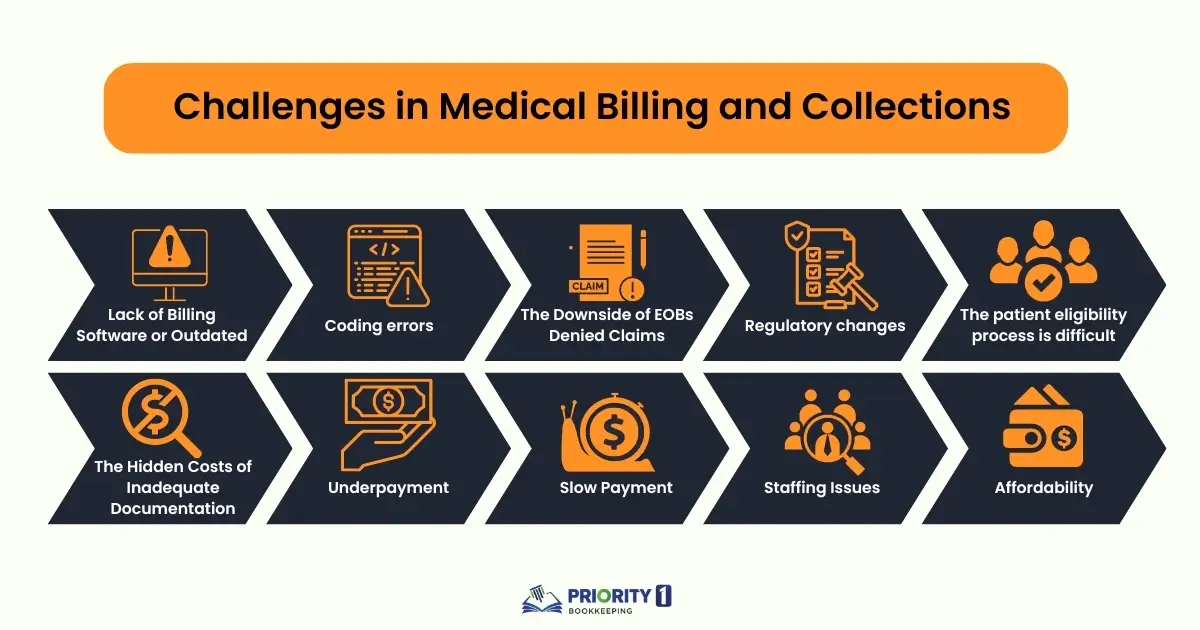

Meeting these challenges frequently demands a mix of new technologies; ongoing staff education training; and streamlined processes needed to handle precise, prompt billingand collections.

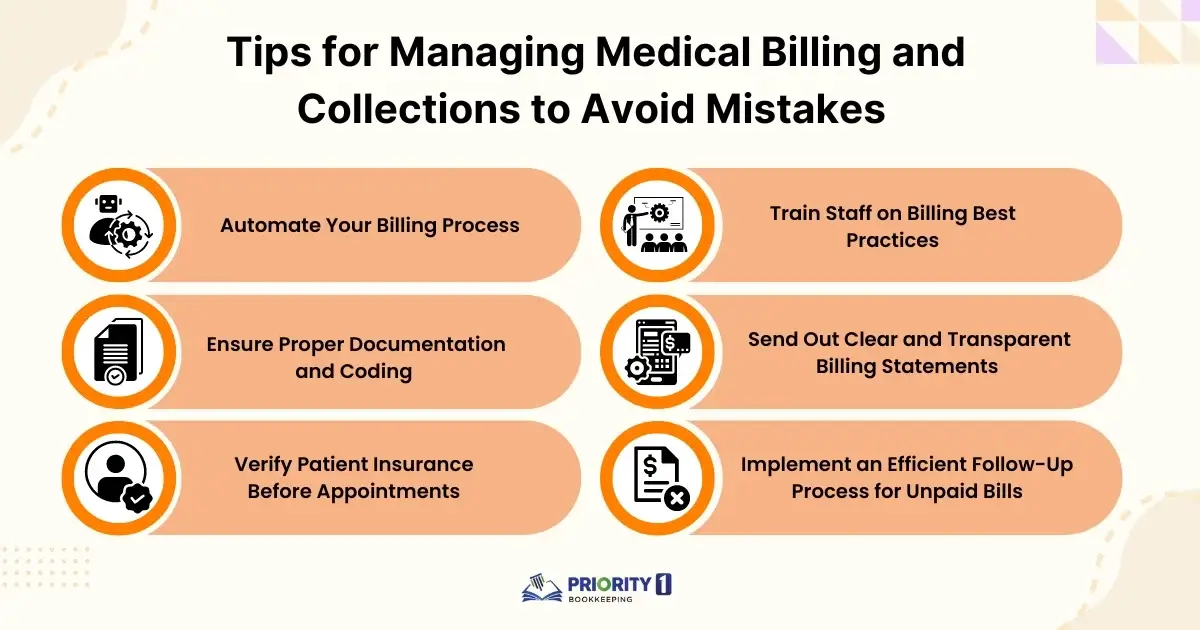

Australian healthcare providers can significantly improve their medical billing process by using billing software designed to handle the complexities of both Medicare and private health claims. Automation helps to eliminate human errors, speed up claims submissions, and simplify the reconciliation of accounts.

By implementing the right medical billing software, healthcare providers can reduce the burden on administrative staff and ensure quicker payments, avoiding the long delays that come with manual claim processing.

Using automated medical billing systems is crucial in Australia to streamline the entire billing cycle, from submitting claims to Medicare or private insurers, to sending out patient invoices. Software solutions like Best Practice or MedicalDirector enable healthcare providers to automatically generate Medicare claims and track payments in real-time.

Automation is especially important when handling bulk billing, where compliance with the MBS codes is mandatory. An automated system ensures you submit correct codes and claim details, reducing the risk of Medicare audits and payment delays.

Accurate coding is essential when submitting claims to Medicare or private health insurers. Mistakes in coding, such as using incorrect MBS item numbers, can lead to claim rejections and delayed payments.

One of the most effective ways to avoid billing complications is to verify a patient’s insurance details before their appointment. This is particularly important when dealing with private health insurance claims.

Verifying insurance details before treatment ensures smoother billing and reduces the chances of disputed claims later.

Your administrative team should be well-versed in medical billing regulations, MBS codes, and private insurance policies. Ongoing staff training ensures that your billing process is compliant and efficient.

Training your staff not only reduces errors but also speeds up claim submission, meaning quicker payments from Medicare and private health insurers.

Billing transparency is critical to maintaining trust and ensuring timely payment from patients. Unclear billing statements can result in confusion, disputes, and delayed payments.

By ensuring your billing statements are easy to understand, you can improve patient satisfaction and increase the chances of getting paid on time.

To maintain a healthy cash flow, it’s important to have a system in place for following up on unpaid bills. Whether the patient owes gap fees or has missed a payment deadline, an efficient follow-up process can help you collect overdue amounts.

By implementing a structured follow-up process, you can significantly improve your collections and ensure your practice’s financial stability.

Poor billing practices can thus become a doom to the bottom line of a health care practice. Billing and collection problems represent significant sources of lost revenue for numerous practices. Delayed payments and unresolved claims prevent providers from covering operational costs, investing in new technologies, and maintaining high levels of patient care.

Poor billing practices can also harm the reputation of a practice. The billing process must be transparent and efficient, and patients as well as insurance providers expect this. Practices that do not meet those expectations risk losing the trust of the patients and further financial difficulties.

There are many reasons why healthcare providers should outsource billing and collections to professional services. Companies specialising in handling healthcare billing’s complexity, from medical bookkeeping to medical accounting, ensure that your practice stays compliant with Medicare and private health insurance regulations.

While mastering bookkeeping can certainly be valuable over time, it’s a task that can be both time-consuming and challenging for many physicians, especially those without a strong financial background. On top of that, physicians often face demanding schedules, leaving little room to manage their financials effectively. Still, the insights gained from analysing the practice’s financial data are crucial. Instead of trying to handle it alone, healthcare providers can hire professional assistance.

There are numerous healthcare management firms with experienced teams and proven success in managing financials. Priority1 Bookkeeping is one such firm that can relieve you of the burden of bookkeeping, while providing well-organised and accurate financial management to keep your practice financially healthy.

Efficient billing and collections are the ways to maintain the financial well-being of any health care practice. Implementing clear billing processes, using technology tools, and outsourcing to professional services that specialise in medical bookkeeping can ensure financial sustainability for healthcare providers while continuing to deliver quality care to patients.

If the billing and collection process gets cumbersome, it may be best to outsource to a professional service that offers customised solutions for optimising billing, collections, and compliance with healthcare regulations. Proper management of your billing will protect the integrity of your practice’s finances while also freeing up more of your time to focus on what truly matters—caring for your patients.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.