For busy professionals, bookkeeping often feels like an unavoidable chore that can easily become overwhelming. As financial records pile up, the process of managing them can drain time, energy, and focus, pulling you away from the core activities that drive your business forward. Yet, efficient bookkeeping is crucial—not just for staying compliant, but also for maintaining a clear and organised financial picture that supports sound decision-making and business growth.

This explores practical efficiency hacks to simplify your bookkeeping process, allowing you to reclaim valuable time, reduce stress, and focus on what truly matters in your professional life. Whether you’re a small business owner, a freelancer, or a professional juggling multiple roles, these strategies will help you manage your finances with greater ease and confidence.

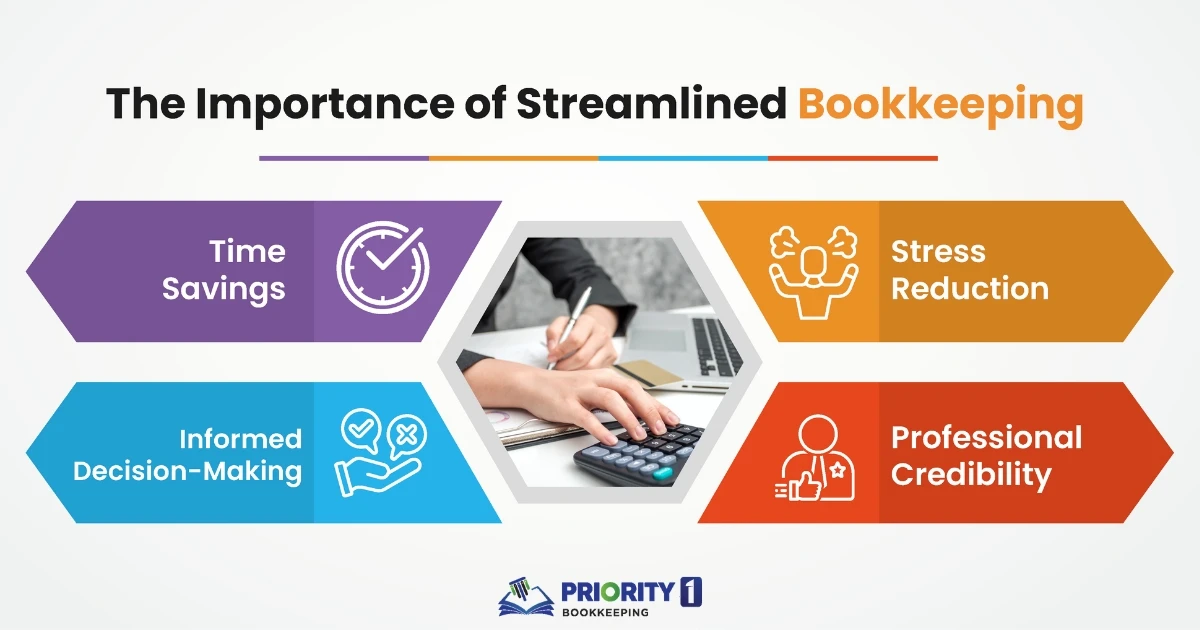

Streamlined bookkeeping is more than just a task to check off your to-do list; it’s a cornerstone of business success. Here’s why:

Time Savings: One of the most immediate benefits of streamlined bookkeeping is the time you save. By implementing efficient systems, such as automation tools and regular financial reviews, you can reduce the hours spent on manual data entry and other repetitive tasks. This allows you to focus on activities that directly contribute to your business growth, such as client relations, product development, or strategic planning.

For professionals in Brisbane, these benefits are magnified by the ability to partner with local Brisbane Bookkeeping services. These experts can provide tailored advice and solutions that meet the specific needs of your business, ensuring that your financial management is as efficient and effective as possible.

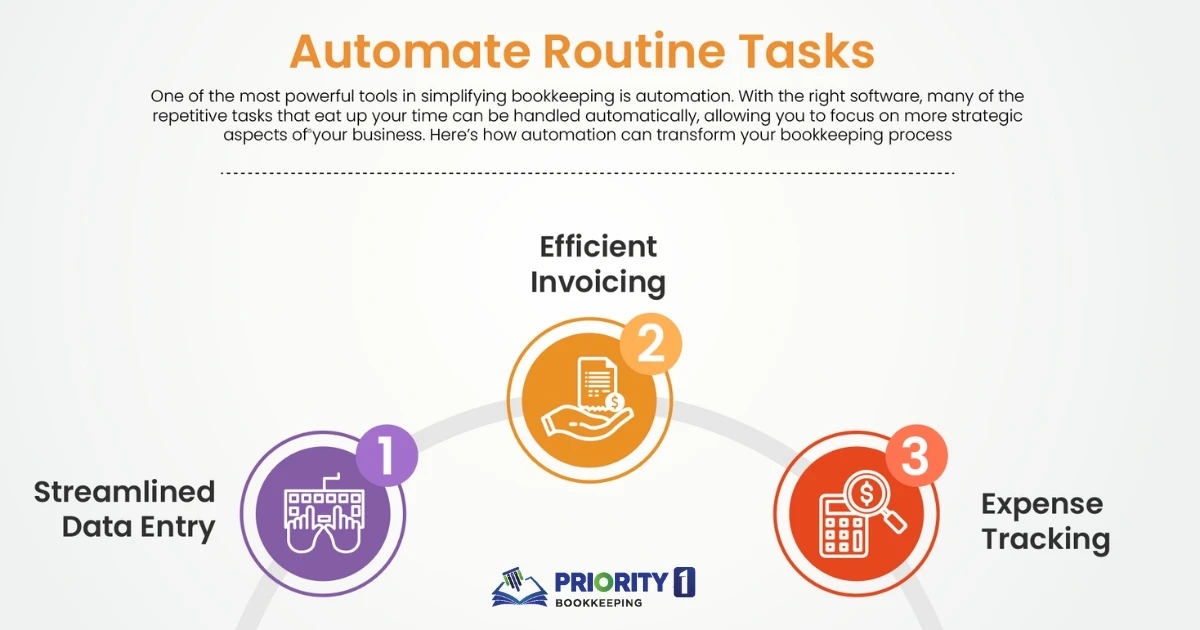

One of the most powerful tools in simplifying bookkeeping is automation. With the right software, many of the repetitive tasks that eat up your time can be handled automatically, allowing you to focus on more strategic aspects of your business. Here’s how automation can transform your bookkeeping process:

By consulting with Brisbane Accounting Firms, you can get recommendations on the best automation tools for your specific business needs. These firms can also provide support in setting up and optimising these tools, ensuring that you get the most out of your investment in automation.

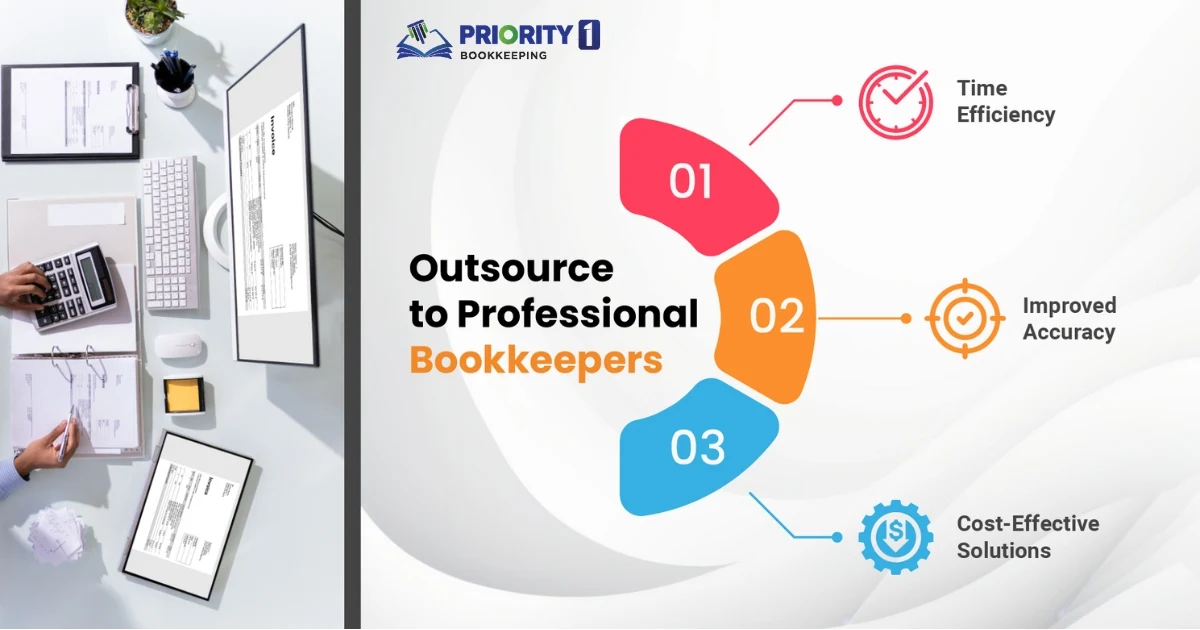

If you find that bookkeeping tasks are taking up too much of your time or causing too much stress, outsourcing to professional bookkeepers might be the solution you need. Here’s why outsourcing can be a smart move:

For more information on the benefits of outsourcing, particularly for small businesses, check out our blog post on Bookkeeping Services for Small Businesses. This resource provides further insights into how outsourcing can help you manage your finances more effectively.

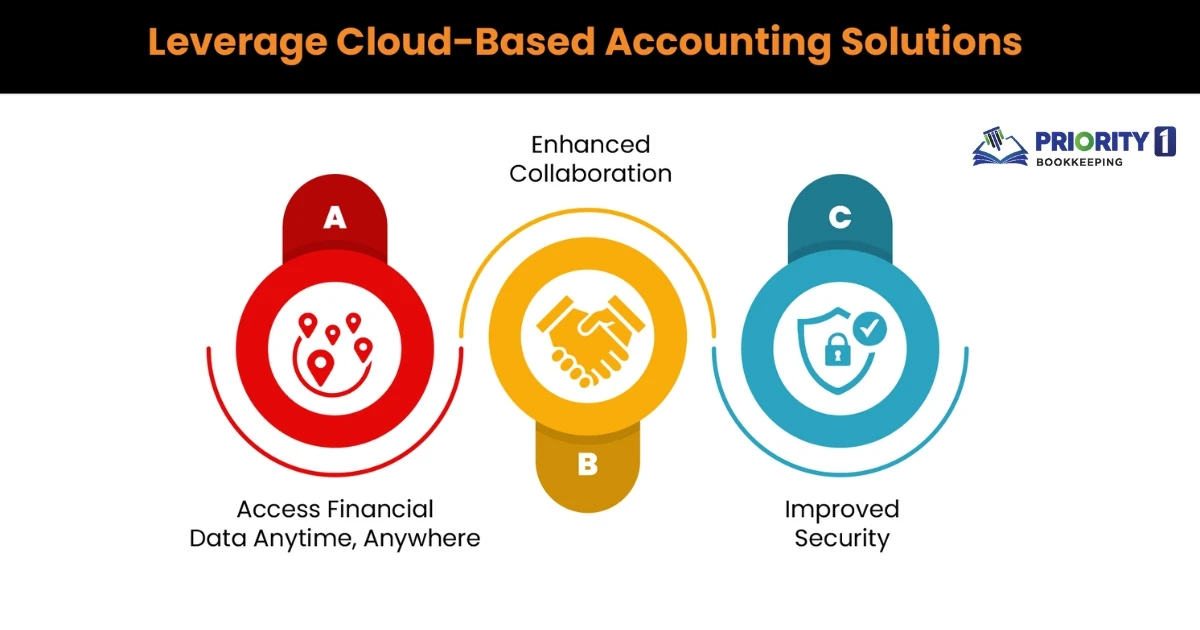

Cloud-based accounting software has revolutionised the way businesses manage their finances, offering flexibility, security, and real-time access to financial data. Here’s how leveraging cloud-based solutions can benefit your business:

1. Access Financial Data Anytime, Anywhere: With cloud-based accounting, your financial data is stored securely online, allowing you to access it from anywhere with an internet connection. This is particularly useful for busy professionals who need to stay on top of their finances while on the go. Whether you’re in a meeting, traveling, or working from home, you can always stay connected to your business’s financial health.

2. Enhanced Collaboration: Cloud-based systems make it easy to share financial information with your accountant, bookkeeper, or business partners. This collaboration can lead to more informed decision-making and ensure that everyone involved in your business has the information they need to do their jobs effectively.

3. Improved Security: Data security is a top priority for businesses, and cloud-based accounting solutions offer robust protection against data breaches and loss. With features like automatic backups, encryption, and secure access controls, you can rest assured that your financial data is safe from unauthorised access and accidental loss.

For professionals in Brisbane, working with local Bookkeeping Services in Brisbane can help you find the right cloud-based tools for your business. These services can also provide ongoing support and training, ensuring that you and your team are fully equipped to take advantage of the benefits that cloud accounting offers.

While automation and outsourcing can simplify bookkeeping, regular financial reviews are still essential for maintaining a healthy business. Here’s why you should make reviewing your financial statements a regular part of your routine:

1. Catch Errors Early: Regularly reviewing your financial statements allows you to identify and correct mistakes before they escalate into bigger problems. Whether it’s an incorrect transaction entry, a miscategorised expense, or a missing invoice, catching these errors early can save you time, money, and stress.

2. Gain Valuable Insights: Financial statements provide a wealth of information about your business’s performance. By regularly analysing your income statements, balance sheets, and cash flow statements, you can gain insights into your profitability, cash flow, and financial health. This information is crucial for making informed decisions and planning for the future.

3. Make Strategic Decisions: Regular financial reviews enable you to make data-driven decisions that support your business’s growth and success. Whether you’re considering a new investment, evaluating your pricing strategy, or planning for expansion, having accurate and up-to-date financial information is key to making sound decisions.

Maintaining a strong relationship with your Brisbane Accounting Firm can help ensure that you’re getting the most out of your financial reviews. These firms can provide expert analysis and recommendations based on your financial data, helping you make decisions that drive your business forward.

Tax regulations are constantly changing, and staying informed about local tax laws is crucial for ensuring compliance and minimising tax liabilities. Here’s how you can stay on top of your tax obligations:

1. Understand Local Tax Requirements: Tax laws vary by region, and professionals in Brisbane need to be aware of the specific tax requirements in their area. This includes understanding the tax rates, deductions, and credits available to your business, as well as any changes to tax regulations that may affect your tax liability.

2. Seek Professional Guidance: Working with a professional bookkeeper or accountant can help you stay compliant with tax laws and optimise your tax strategy. These experts can help you navigate the complexities of tax regulations, identify opportunities for tax savings, and ensure that your tax returns are accurate and filed on time.

3. Plan for Tax Season: Preparing for tax season is much easier when you’re organised and up-to-date throughout the year. Regular financial reviews, accurate record-keeping, and staying informed about tax regulations can help you avoid the stress of last-minute tax preparation and ensure that you’re ready when tax season arrives.

For expert guidance on tax compliance and planning, consider partnering with Professional Bookkeeping Services in Brisbane. These services can provide the support you need to stay compliant and make the most of your tax strategy.

Simplifying bookkeeping doesn’t have to be a daunting task. By implementing these efficiency hacks—such as automating routine tasks, outsourcing to professionals, leveraging cloud-based solutions, regularly reviewing financial statements, and staying updated on tax regulations—you can take control of your finances and focus on growing your business.

For busy professionals looking for expert assistance in streamlining their bookkeeping processes, Priority1 Bookkeeping is here to help. With our tailored services, we ensure that your financial records are accurate, compliant, and easy to manage, allowing you to concentrate on what you do best. Let Priority1 Bookkeeping handle the details so you can focus on your success.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.