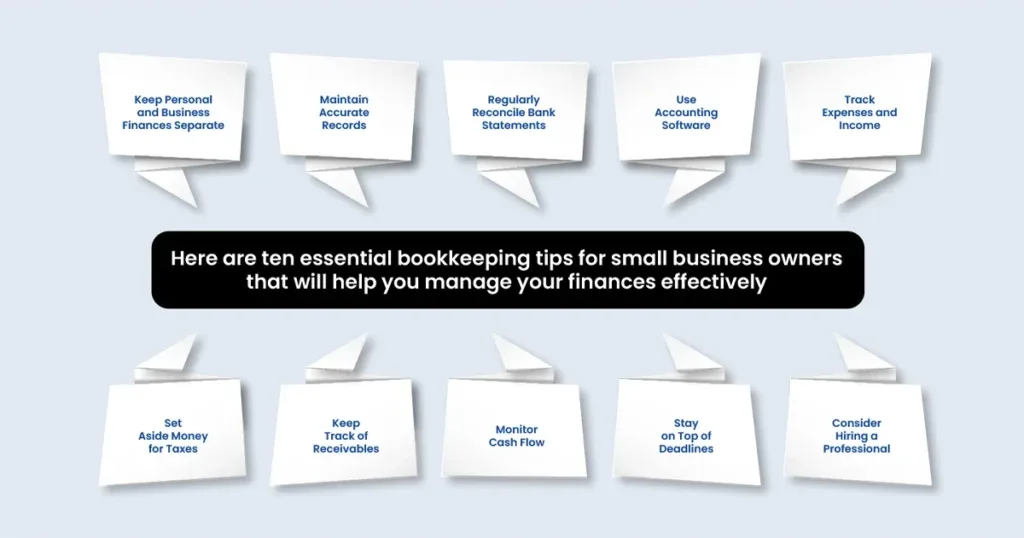

Running a small business comes with many responsibilities, and keeping track of your finances is one of the most crucial. Proper bookkeeping ensures that your business runs smoothly and remains financially healthy. This blog takes you through essential bookkeeping tips for small business owners that will help you manage your finances effectively.

One of the first steps in small business bookkeeping is to keep your personal and business finances separate. This involves having separate bank accounts and credit cards for your business and personal use. Doing so will make it easier to track business expenses, manage your finances, and avoid potential tax issues.

Accurate record-keeping is the backbone of effective bookkeeping. Ensure that you keep detailed records of all your financial transactions, including receipts, invoices, and bank statements. This practice will help you monitor your cash flow, prepare for tax season, and provide a clear picture of your business’s financial health.

Bank reconciliation involves comparing your business’s financial records with your bank statements to ensure that everything matches. This process helps identify discrepancies, errors, and unauthorised transactions. Regularly reconciling your bank statements ensures that your records are accurate and up-to-date, making it easier to spot and correct any issues promptly.

Investing in accounting software can greatly simplify the bookkeeping process for small businesses. Popular options like QuickBooks, Xero, and FreshBooks offer automation features that save time and reduce errors. These tools also provide easy-to-understand financial reports, which can help you make informed business decisions.

Properly categorising and tracking your expenses and income is essential for effective bookkeeping. Whether you use a spreadsheet or accounting software, make sure to log all financial transactions accurately. This practice not only helps in monitoring your cash flow but also ensures that you are prepared for tax season with all necessary documentation.

Taxes can be a significant expense for small businesses, and failing to prepare for them can lead to financial strain. Set aside a portion of your income regularly to cover your tax obligations. Estimate your tax liability and save accordingly to avoid last-minute scrambles and ensure that you can meet your tax deadlines without stress.

Accounts receivable management is crucial for maintaining a healthy cash flow. Monitor your receivables closely and follow up on overdue invoices promptly. Implementing a systematic approach to invoice tracking and collections can help ensure that your business gets paid on time and avoids cash flow issues.

Cash flow is the lifeblood of any business. Regularly monitoring your cash flow helps you understand the inflows and outflows of your business and anticipate potential shortfalls. Create cash flow statements to track your financial performance and identify areas where you can improve your cash management practices.

Meeting financial deadlines is critical for maintaining the financial health of your business. This includes paying bills on time, filing taxes, and sending out invoices promptly. Use a calendar or accounting software to keep track of important dates and set reminders to ensure you never miss a deadline.

As your business grows, managing bookkeeping tasks can become increasingly complex and time-consuming. Hiring a professional bookkeeper for your small business can save you time and ensure that your financial records are accurate and up-to-date. Professional bookkeeping services for small businesses provide expertise and peace of mind, allowing you to focus on growing your business.

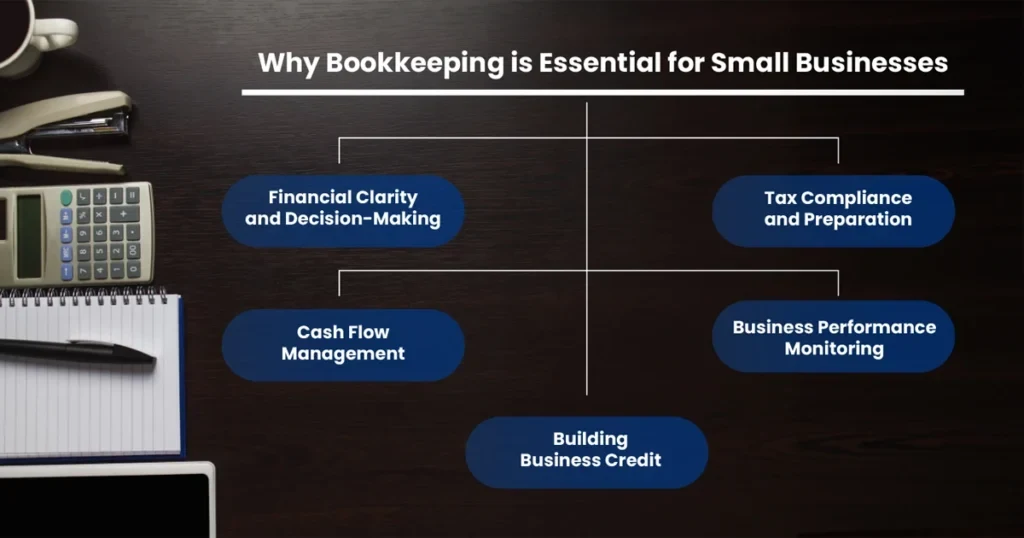

Bookkeeping is more than just a necessary task for compliance; it’s a vital component of running a successful business. Here’s why effective bookkeeping is essential for small businesses:

Accurate bookkeeping provides a clear picture of your business’s financial health. It enables you to make informed decisions based on up-to-date financial data, helping you plan for the future and avoid costly mistakes.

Maintaining detailed and accurate records simplifies the tax preparation process. It ensures that you have all the necessary documentation to claim deductions and credits, potentially saving your business money.

Effective bookkeeping helps you monitor and manage your cash flow, ensuring that you have enough funds to cover expenses and invest in growth opportunities. It allows you to identify and address cash flow issues before they become critical.

Regular financial reporting and analysis provide insights into your business’s performance. By tracking key metrics and trends, you can identify areas of strength and opportunities for improvement.

Consistent and accurate bookkeeping helps build your business’s creditworthiness. Lenders and investors are more likely to trust a business with well-maintained financial records, improving your chances of securing financing when needed.

Implementing these ten essential bookkeeping tips for small business owners will help you maintain accurate records, manage your finances effectively, and ensure the financial health of your business. Whether you’re just starting out or looking to improve your existing bookkeeping practices, these tips provide a solid foundation for success.

If you find that bookkeeping is taking too much of your time or you need expert advice, consider hiring professional bookkeeping services for small businesses. At Priority Bookkeeping, we offer comprehensive bookkeeping and accounting services tailored to the needs of small businesses. Contact us today to learn how we can help you manage your finances and achieve your business goals.

By following these tips and leveraging professional services, you can focus on what you do best – growing your business. Effective bookkeeping not only keeps your business compliant but also provides the financial clarity needed to thrive in today’s competitive market.

For the best bookkeeping services in Brisbane, turn to Priority1 Bookkeeping. Our experienced team is dedicated to helping small businesses maintain accurate financial records, ensuring compliance, and optimising financial performance. Let us handle your bookkeeping needs so you can focus on growing your business. Contact us today to learn more about our tailored bookkeeping services for small businesses.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.