“Bookkeeping is where accuracy and diligence meet.”

Today’s competitive business demands the crucial role of accurate bookkeeping more than ever. Bookkeeping is the systematic recording and organising of financial transactions in a business. It is the backbone of any thriving business, providing a clarity into the enterprise’s financial health, facilitating informed decision-making. For enterprises small and medium (SMEs) functioning in trending economic hubs like Brisbane, it is essential to understand the role of accurate bookkeeping for sustained growth and success. Accurate bookkeeping gives enterprises a reliable picture of their performance. You can get information to take strategic decisions setting a benchmark for the revenue and income goals. Bookkeeping when done accurately ensures that the enterprise’s financial transactions are consistently recorded, archived and preserved safe. Efficiency in bookkeeping fosters accurate and properly organised data that can lead to critical economic decisions for enterprise owners and stakeholders.

Bookkeeping is defined as the process of tracking income and expenses in your business. It gives you the picture of your cash flow position and the overall health of your business. Staying in control of your bookkeeping is crucial so that your business does not have unexpected imbalances in the account expense management.

Accuracy refers to the correctness and precision maintained in financial records and reports. This principle is fundamental and objective because accurate financial date plays a crucial role in making calculated business decisions.

There are 6 important components of bookkeeping:

Bookkeeping services need to maintain accuracy because it helps enterprises meet its tax requirements, avoid penalties, and keep up a good reputation with regulatory bodies. Accurate bookkeeping aids in making informed decisions based on appropriate rather than guesswork. It also helps in strategic planning by giving clarity over the enterprise’s financial position. Then only can realistic and achievable plan be developed.

Accurate bookkeeping helps in measuring key performance indicators. Tracking the financial date of a business can help measure its performance against its goals and objectives. You can identify areas where you can improve the business and bring in changes to improve the financial performance.

Accurate bookkeeping is vital to timely tax preparation. It ensures that tax liabilities are properly calculated. Now tax returns can be filed on time to avoid penalties and audits. Bookkeeping for small businesses ensures that all financial records are accurate and up-to-date to avoid penalties and potential tax deductions.

Ensuring compliance with legal and tax regulations can happen when you have updated your records with accurate date to meet the reporting requirements. You can also conduct regular audits of your financial records to identify errors, discrepancies and correct it. Maintaining accurate records can establish credibility for stakeholders. As a business owner, you can identify trends in the business’ financial performance and allocate resources and plan ahead for the future.

Priority1 Bookkeeping offers bookkeeping services in Brisbane, Australia to simplify your workload with professional bookkeeping solutions. The team includes professionally trained, skilled financial personnel who will carefully tailor services to meet your needs and even exceed your expectations.

They do not follow traditional approaches but understand your business needs to deliver effective results. Whether you are a SME or an enterprise, you can trust the bookkeeping services to provide reliable and transparent financial guidance and support.

Priority1 bookkeeping provides essential financial management and reporting for businesses for all sizes. Your business can grow faster when you take their services. Here are the key services offered and their significance:

It ensures accurate financial records, essential for tracking business performance and making informed decisions.

It guarantees compliance with local tax laws, avoids penalties, and maintains employee satisfaction through timely and accurate payments.

It enhances cash flow management, ensures timely payments to suppliers, and improves customer relations through efficient billing processes.

You can detect and resolve discrepancies, prevent fraud, and ensure accurate financial reporting.

You can ensure compliance with Australian Taxation Office (ATO) requirements, avoids penalties, and maintains accurate tax records.

It ensures accurate asset valuation, aids in tax preparation, and supports effective asset utilisation and replacement planning.

It provides insights into the business’s financial health, aids in strategic planning, and fulfils regulatory requirements.

This ensures the business has sufficient cash to meet its obligations, prevents liquidity issues, and supports growth initiatives.

It helps maintain optimal inventory levels, reduces holding costs, and prevents stockouts or overstocking.

It aids in strategic planning, ensures resource allocation aligns with business goals, and identifies potential financial challenges.

Businesses optimise their financial practices, improve profitability, and achieve long-term success.

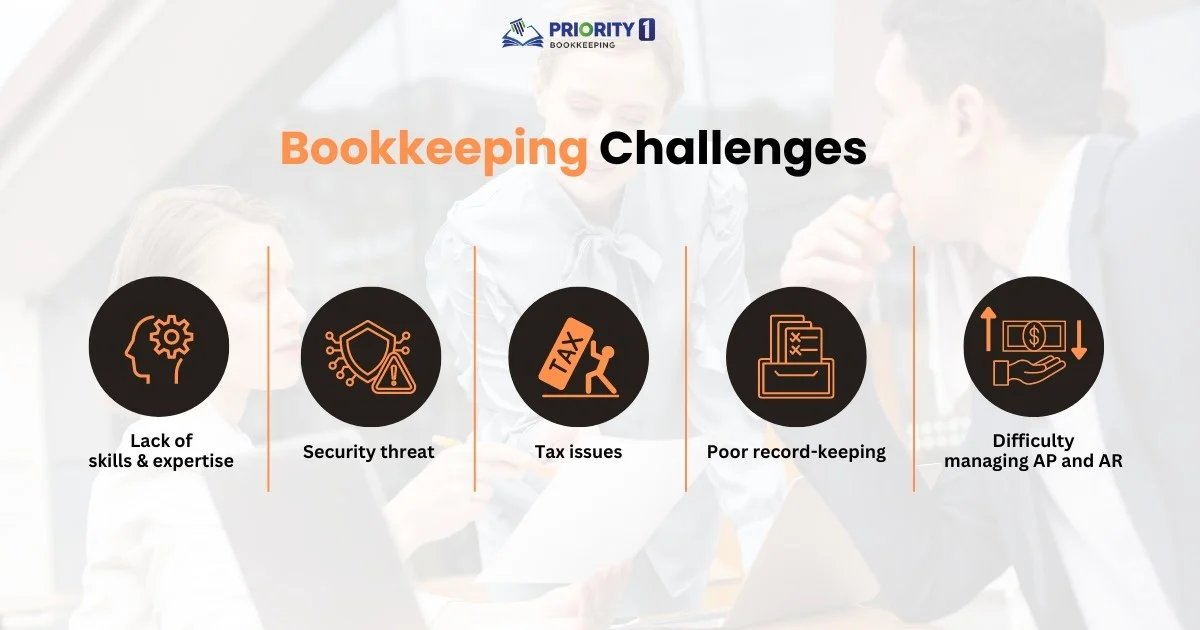

It is crucial to stay on top of your bookkeeping as it is important to your company’s financial health otherwise it will have costly implications that can cost your business.

It is vital for your business that you identify these bookkeeping issues and resolve them then you can identify profitable opportunities, avoid costly errors, and lead your enterprise towards long-term success.

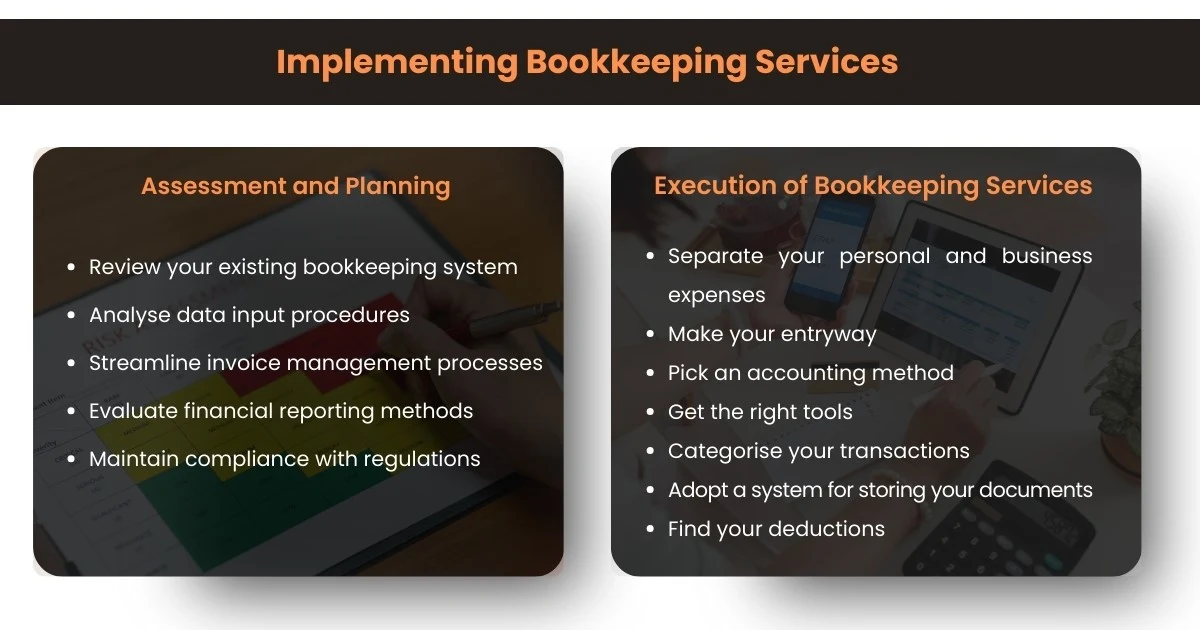

You need to assess and examine your bookkeeping practice because it will optimise your financial management process. Also, you need to identify areas where you can refine your bookkeeping workflow

A step-by-step bookkeeping implementation process is:

Tools and technologies that can be used for accurate bookkeeping are

Bookkeeping allows you to proactively monitor your business’ financial condition consistently. You can track your business finances, analyse your cash flow and make data-driven decisions to drive your success.

Best practices to enhance financial reporting for businesses are:

You can use tools and available technologies to analyse financial data in real-time and identify trends and patterns. This will help enterprises to make informed decisions. You decision-making capabilities will become better once you use these well-assessed reports and data to improve your business’ health and success.

Regulatory compliance in bookkeeping is not a mere formality but a fundamental aspect of maintaining trust, accuracy and financial stability. Bookkeepers must have a thorough understanding of regulations that apply to their particular industry. Keeping up-to-date with any regulatory changes is crucial as well.

Tax risk management involves identifying, assessing and ease tax risks that could affect enterprises and SMEs. This process minimises the potential negative consequences of tax risks–financial penalties, legal issues, reputational damages. When this process is effectively done, it could enhance a business’s reputation and build long-term stability

A business is a well-functioning machine only when every part is working properly. Bookkeeping diagnoses each function to ensure everything runs smoothly.

Accurate bookkeeping helps you gain a snapshot of your business. It helps your streamline your business operations by reducing overhead costs, and enhance overall productivity. It focuses on core business activities by identifying profitable opportunities and cost-cutting areas, ultimately leading to improved operational efficiency.

Accurate bookkeeping is crucial for sustained growth and overall success of SMEs and enterprises in Brisbane. As an enterprise, you can prepare correct financial records by making informed decisions and strategise effectively based on appropriate data. Key services as bookkeeping, payroll management and financial reporting are vital to maintaining financial health and compliance.

Further, you can achieve timely tax preparation, enhanced financial reporting and regulatory compliance through accurate bookkeeping. You can overcome common bookkeeping challenges by leveraging tools and techniques to aid and automate the process. This will improve operational efficiency and profit. When you practice these methods, it will help you identify opportunities, avoid costly errors and drive long-term business success. Your enterprise in Brisbane can now thrive in the Brisbane market.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.